MORTGAGES PERSONALIZED FOR YOU

Secure your financial future today!

Whether buying a home, refinancing or consolidating your debts, Dove Mortgages provides personalized options for your financial situation. If you want to take control of your financial future and entrust your financing to the experts, you can apply online today using our contact form.

Our Lenders.

We partner with over 30 lenders to ensure

you find the perfect mortgage solution for your needs.

Some of our trusted lenders include:

Our Services

At Dove Mortgages, we understand that your financial situation is unique. This is why we offer services designed to assist you in achieving your financial goals.

Whether buying a first-time home, consolidating debt or refinancing, we are here to provide you with expert guidance. Explore our services below and see how we can help you today.

Refinance Your Home

Are you looking to lower your monthly payments or use your home’s equity? We can help you secure a better mortgage rate that meets your financial goals.

First-Time Homebuyer

Are you a first-time homebuyer? We’ll guide you through every step of the process, helping you secure a mortgage that fits your budget.

Buying Your Next Home

Are you ready to move? We offer many flexible mortgage options with competitive rates to make the transition to your next property as smooth as possible.

Renewals and Transfers

With us, you can easily renew or transfer your mortgage. Take advantage of better rates and terms with us. We’ll guide you throughout the mortgage process and help you get the most out of your new mortgage.

Get Pre-Approved In Mins

Our mortgage brokers can help you get pre-qualified quickly, clearly showing how much you can afford. This information lets you confidently start your home search and make informed decisions.

Debt Consolidation

Our mortgage brokers specialize in helping you simplify your finances by consolidating multiple debts into one manageable payment. By reducing interest rates and streamlining payments, you’ll relieve financial stress and take back control of your finances.

Mortgage Tools Just for You

We offer a range of tools to help you understand our services and make the mortgage process easier. These include tools such as:

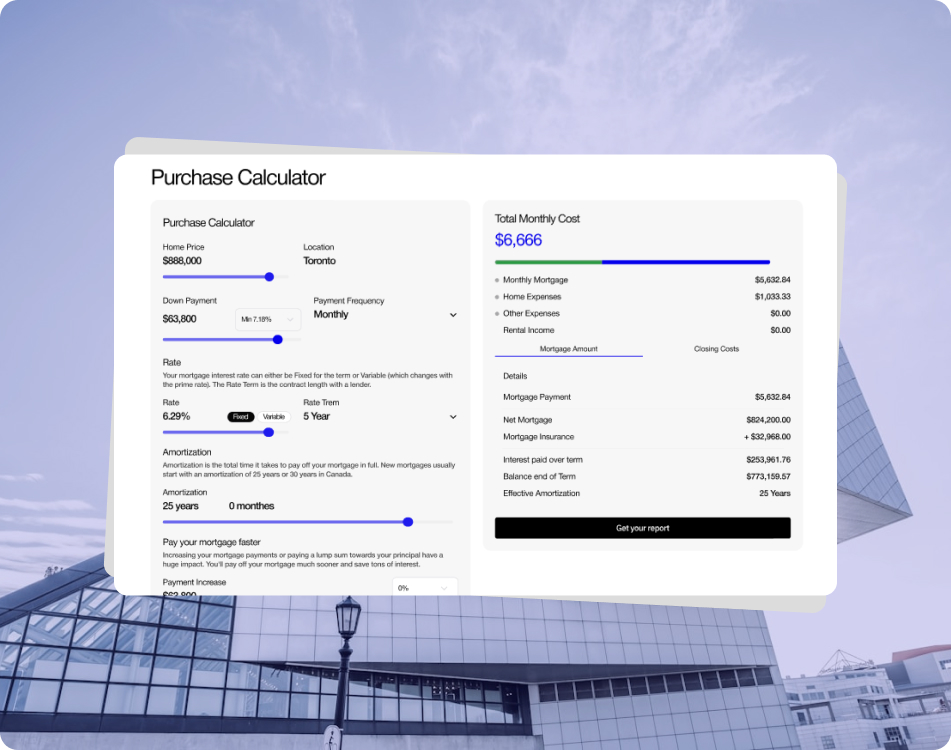

Purchase Calculator

Are you curious about how much home you can afford?

Our Purchase Calculator helps you quickly estimate your mortgage affordability by determining the home price, down payment, and interest rates. It’s perfect to get an instant look at your monthly payments and overall loan costs!

Use the Purchase Calculator now and take the first step toward owning your dream home

Closing Costs Calculator

Don’t get caught off guard by hidden fees at closing. Our Closing Costs Calculator breaks down the closing costs you’ll need to cover when purchasing a home, including legal fees, land transfer taxes, and other ancillary charges.

Use our Closing Costs Calculator today and avoid last-minute surprises!

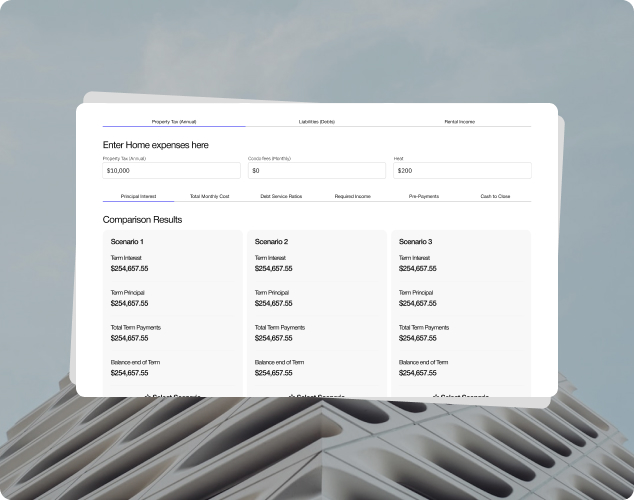

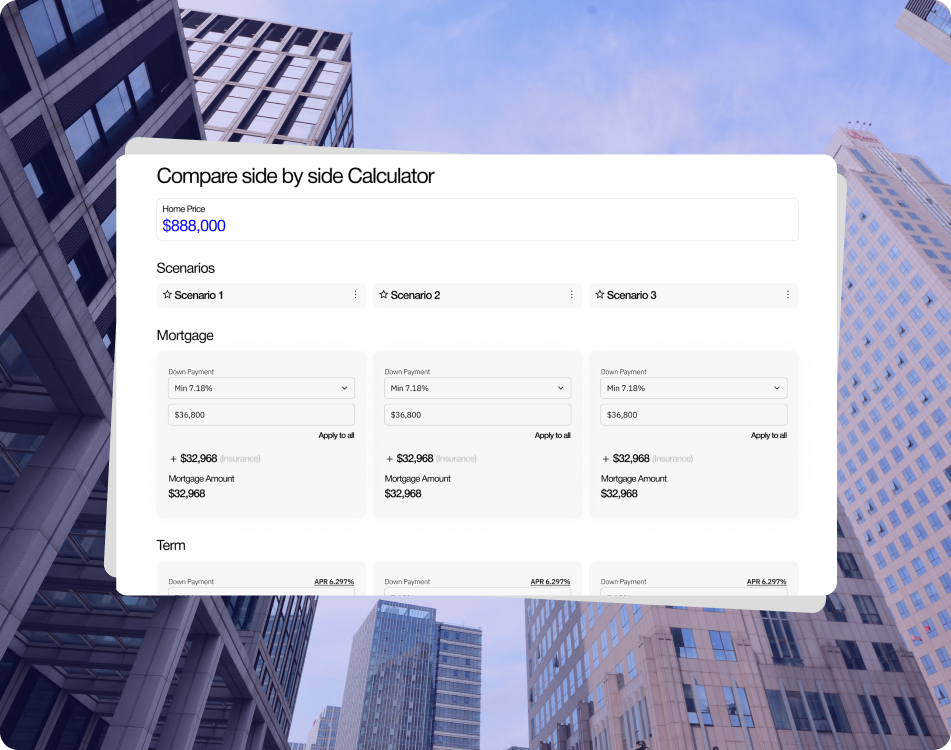

Side-by-Side Comparison Calculator

Not sure which mortgage option is right for you? Our Side-by-Side Comparison Calculator helps you compare multiple mortgage scenarios quickly. Whether it’s fixed vs. variable rates or different amortization periods, this tool shows how each option affects your payments and long-term costs.

Click here to compare mortgage options now!

Our Step-by-Step Process

At Dove Mortgages, we focus on personalized services. Our Mortgage experts guide you through your mortgage options with a simple, easy-to-follow process. Here’s how it works.

First, we’ll sit down to talk with you about your financial situation and goals. This helps us establish what mortgage plan is right for you. Some financial steps we recommend include the following:

- Reviewing your credit score

- Setting up a budget

- Reducing debt

- Saving for a down payment

Getting pre-approved helps you understand how much you can borrow and shows sellers that you’re a serious buyer in today’s competitive market. It also allows us to evaluate your affordability.

Getting pre-approved helps you understand how much you can borrow and shows sellers that you’re a serious buyer in today’s competitive market. It also allows us to evaluate your affordability.

Don't stress about the paperwork—our team will handle all communication with lenders to ensure a smooth application process. Our team will keep you in the loop every step of the way, making sure you understand all the details clearly.

After approval, we will help you with the final steps and work with the lender to ensure your payment plan structure is straightforward. Even after you close we’ll continue offering support and guidance whenever needed.

Start Your Jorney

Client Testimonials Google Review

Posted onTrustindex verifies that the original source of the review is Google. We had an excellent experience working with Shabnam as our mortgage broker. She is extremely knowledgeable, professional, and always willing to go the extra mile. As first-time home buyers, we had many questions, and she patiently explained every step of the process, making everything smooth and stress-free. Shabnam provided clear guidance, honest advice, and great mortgage options that suited our needs. She was always responsive, friendly, and supportive throughout the entire journey. We truly felt confident and well taken care of. Highly recommend Shabnam to anyone looking for outstanding mortgage services!Posted onTrustindex verifies that the original source of the review is Google. Thank you Shabnam and Kiran, You did an excellent job and helped us secure a great financing deal and loan amount. I’m truly grateful to you for all the support and guidance in getting us to pay our fist home. Thank you again for everything.Posted onTrustindex verifies that the original source of the review is Google. Shabnam, Kiran and Kate went above and beyond to help my wife and I find a solution for a complicated and comprehensive mortgage and line of credit problem we had. They found a best case solution for us and worked our case until everything was problem solved and finalized. They communicated instantly and were always available for questions and guidance throughout the process. I would high recommend this team to anyone needing mortgage or line of credit solutions!Posted onTrustindex verifies that the original source of the review is Google. I am completely satisfied with Shabnam and her team, Great Service. Definitely I will come back to her.Posted onTrustindex verifies that the original source of the review is Google. As a first-time home buyer, the mortgage process felt overwhelming at first, but working with Shabnam and her team made everything smooth and stress-free from start to finish. They took the time to clearly explain every step, answered all of my questions patiently, and made sure I fully understood my options before moving forward. The team was extremely responsive, professional, and genuinely cared about finding the best solution for my situation—not just closing a deal.Posted onTrustindex verifies that the original source of the review is Google. As first-time home buyers, my family and I couldn’t have asked for a better experience. Shabnam and her team were incredibly knowledgeable, attentive, and supportive throughout the entire mortgage process. They broke everything down in a way that was easy to understand, kept us informed at every stage, and were always available whenever we had questions. Their attention to detail and proactive communication gave us peace of mind and made the whole process feel simple and well organized.Posted onTrustindex verifies that the original source of the review is Google. We had a great experience with Shabnam . Shabnam and her team did a great job to get our dream home . Shabnam was there for us all through the home buying process. I had a very positive experience with dove mortgage. Thanks again to all team members.Posted onTrustindex verifies that the original source of the review is Google. I had an excellent experience working with my mortgage lawyer, Shabnam. Her continuous support at every step of the loan approval process made a huge difference for me. She was completely transparent, clearly explained every detail, and guided me through each stage with patience and professionalism. What could have been a stressful process turned into something smooth, easy, and truly hassle-free. I am very grateful for her dedication and highly recommend her services.Load moreVerified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more

Blog

Frequently Asked Questions

What Is a Mortgage?

A mortgage is a loan used to purchase property, where the property serves as collateral for the loan.

What’s the Difference between a Fixed-Rate and a Variable-Rate Mortgage?

With a fixed-rate mortgage, the interest rate remains constant for the entire term of the loan period. Whereas,variable-rate mortgage changes over time based on shifts in the economic environment and market conditions.

How Long Does It Take To Get Mortgage Pre-Approval?

If you provide us with all the required supporting documents, our experts will pre-approve you in 24 hours.

What Documents Do I Need to Apply for a Mortgage?

For Salaried Clients:

- Two recent pay stubs

- The last two years of T4s

For Hourly, Part-time, or Contract Workers:

- Two recent pay stubs

- The last two years of T4s

- Employment letter confirming guaranteed hourly rate and number of hours

For Self-Employed Clients:

- The last two years of T1 Generals

- Articles of Incorporation or Master Business License

For All Borrowers:

- Equifax credit report that they can get on their own for free

- Two pieces of ID (excluding health cards and SIN)

- For any existing properties: a copy of the current mortgage statement, the latest property tax bill, and the lease agreement (if the property is a rental)

- For those receiving child benefit or pension, a bank statement showing the benefit amount

What does Refinancing mean?

Homeowners may choose to refinance their mortgage for various reasons, including:

- Lower Current Interest Rate — This will decrease your mortgage payments

- Change Time Frame Of Loan — You can re-amortize your loan by increasing the time frame from 25 to 30 or vice versa.

- Change Loan Type — You may want to change from a variable rate to a fixed rate or vice versa.

- Obtain Access Home Equity — A homeowner can pay down their mortgage balance or home value increases, which results in build-up equity.

- For example, if a home is worth $500,000 and the homeowner owes $200,000 on the mortgage, they have $300,000 in equity.

- The homeowner can use the $300,000 for investments, have an emergency fund, use it towards home improvement, or use it towards child education.

What Are the Benefits of Debt Consolidation through a Mortgage with Dove Mortgages?

We will analyze all your high-interest debts (credit cards, personal loans, etc) and strategize which debts to consolidate/combine into one low-interest mortgage payment. This will save you thousands.